how are property taxes calculated at closing in florida

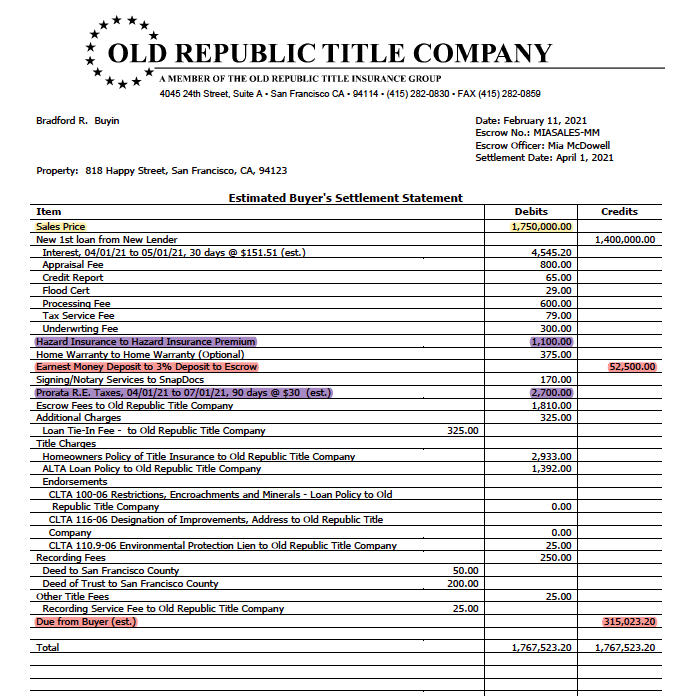

What are closings costs. The actual amount of the taxes is 477965.

Reality Tv Show Myths Infographic Real Estate Infographic Real Estate Advice Real Estate Investing

Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day.

. It may seem insignificant but the amount you have to pay can quickly climb if youre buying an expensive home. The average closing costs in Florida come to approximately 258 of the purchase price. This is why property taxes are based on the previous years.

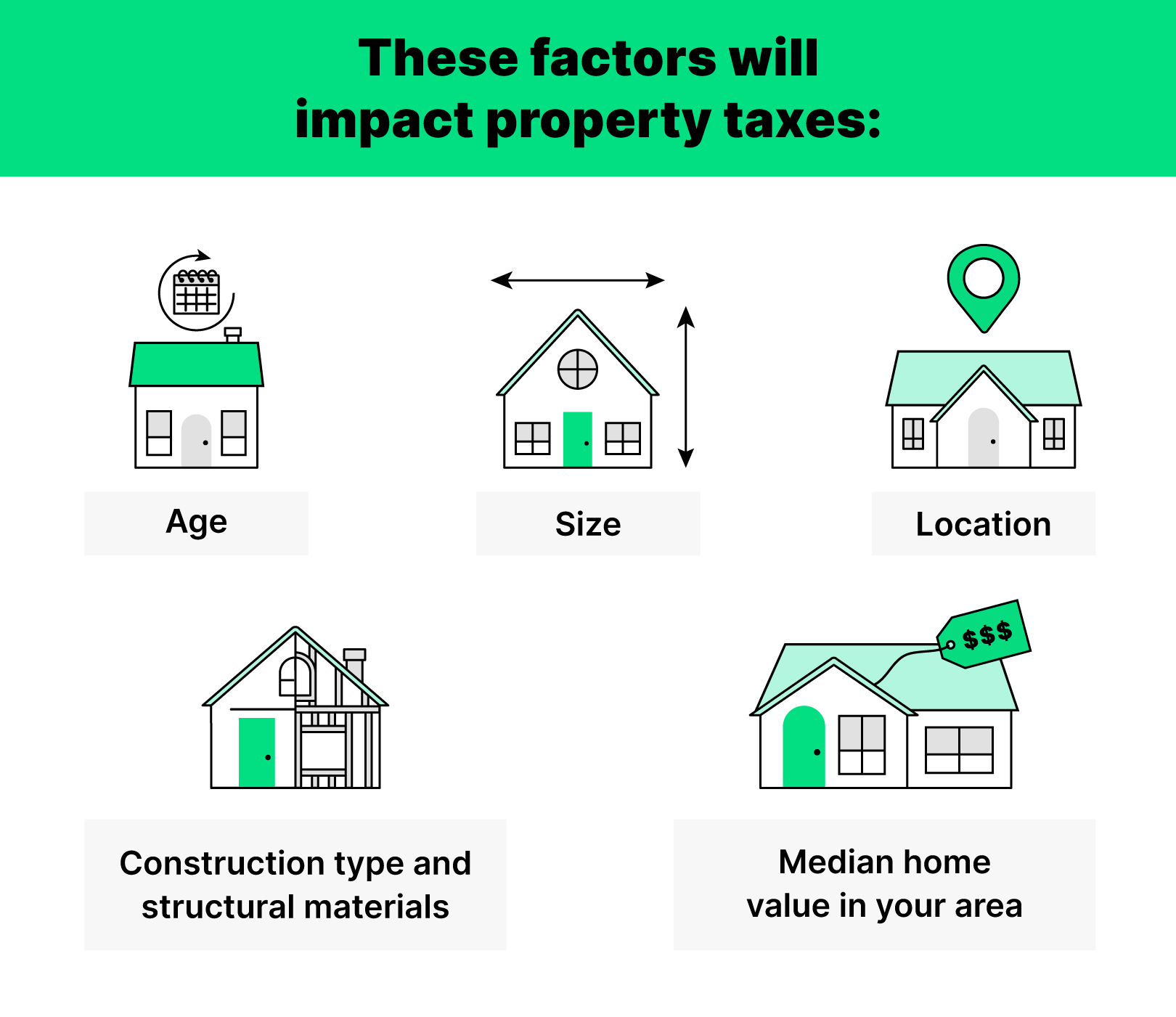

Property taxes throughout Florida and Palm Beach county and the Treasure Coast are based on millage rates which are used to calculate your ad valorem taxes. So Ted seller will pay Bob buyer a prorated credit for taxes based on last years amount. In the State of Florida property taxes are assessed in November of the year in which they are due.

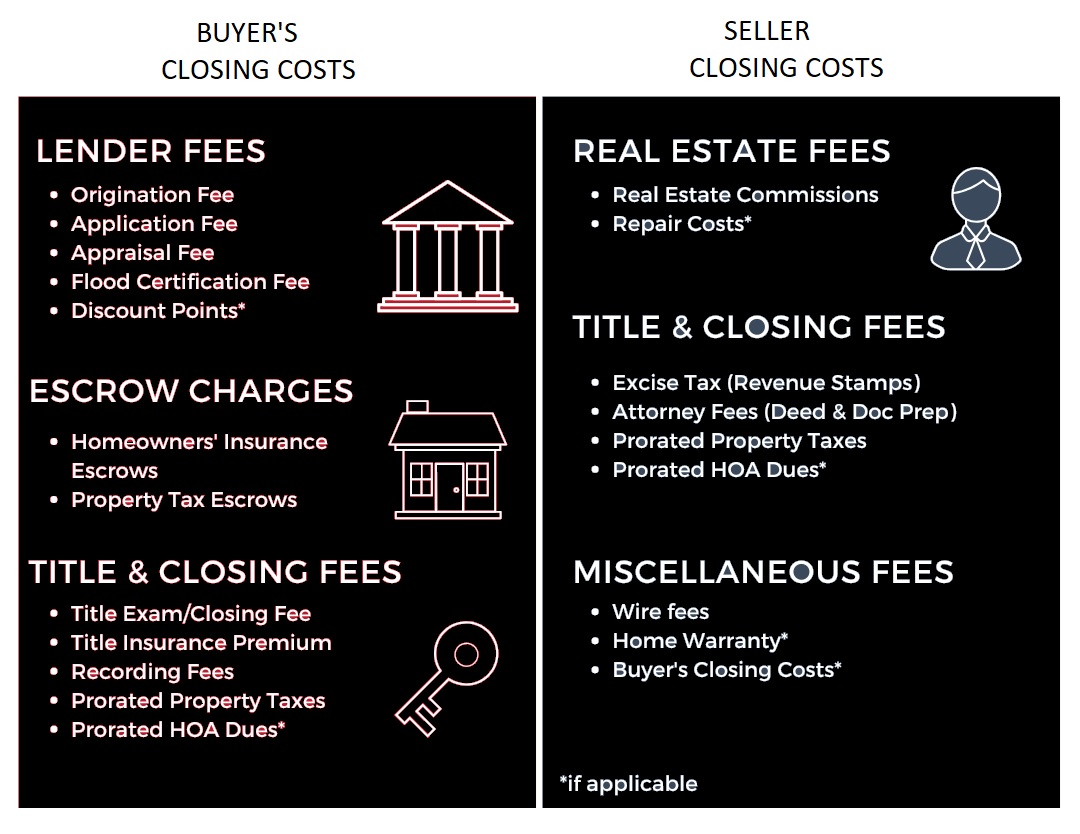

Heres an overview of the closing costs you can expect to pay when buying a home in Florida. Every state has a transfer tax of some sort which is essentially a fee the state charges to transfer a property from one party to the other. Lets look at the 2015 Ad Valorem taxes in detail.

Across the state the average home sells for somewhere between 300000 and 400000. It frees the first 25000 of the homes assessed value from all property taxes and it exempts another 25000 from non-school property taxes. Optional survey fees normally between 300 and 500 some lenders require surveys of a property before theyll release a loan to a.

We dont know what the property taxes for 2021 will be until November. Tax amount varies by county. When it comes to real estate property taxes are almost always based on the value of the land.

One mil equals 1 for every 1000 of taxable property value which is after exemptions if applicable. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Floridas average real property tax rate is 098 which is slightly lower than the US.

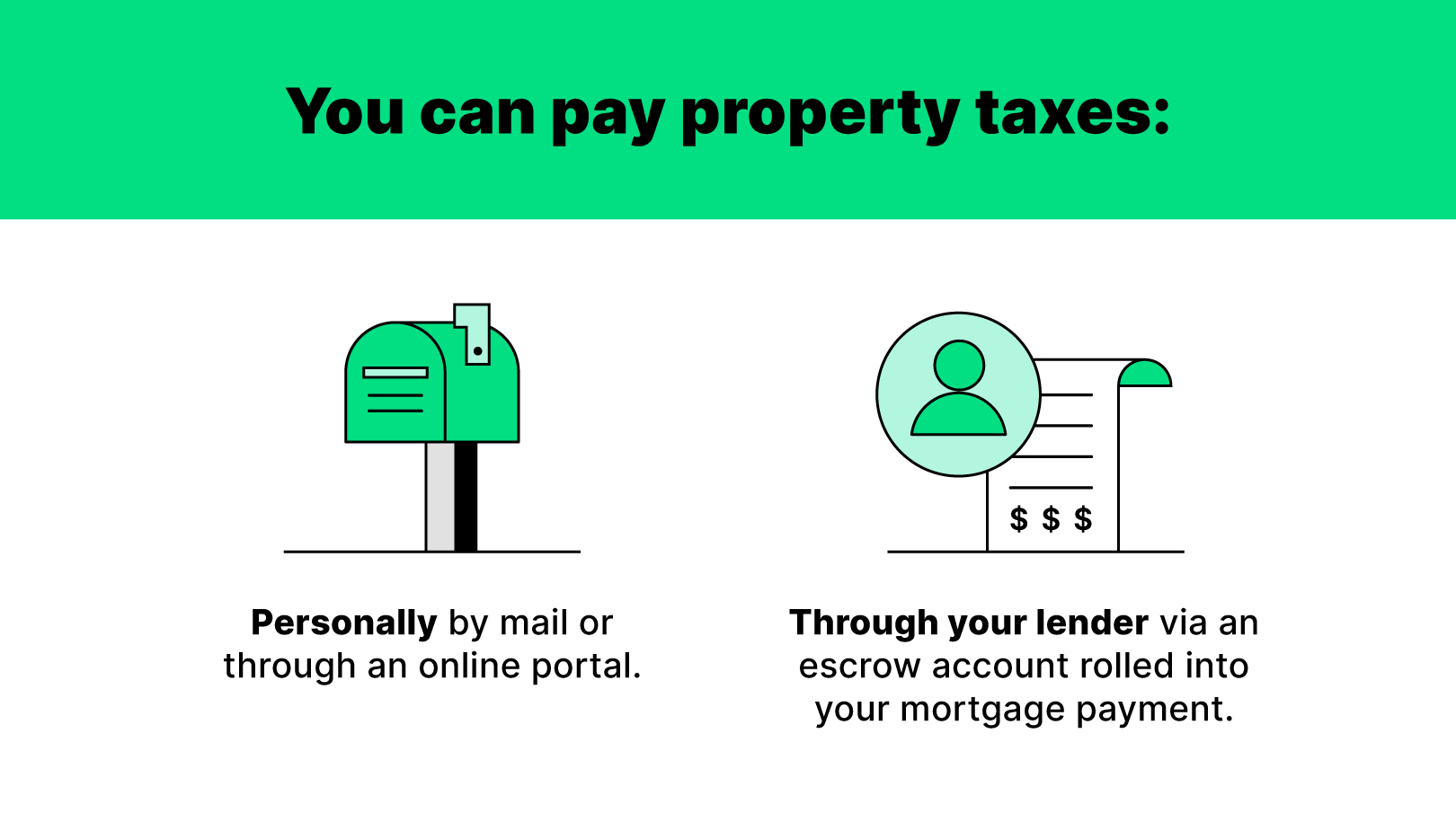

With respect to how property taxes are handled and paid at the closing in Florida effectively the property taxes are paid by the seller through the date of the closing in Florida. Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount. Since the closing date does not line up with the exact date a property tax bill is due the property taxes are pro-rated between the buyer and seller.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. All of these extraneous costs will be prorated to your closing date. 097 of home value.

How much is the property tax in Florida. This can get confusing so heres an example. Ted owned the house for 8 out of 12 months.

The first 25000 would be exempt from all property taxes. Appraisal fees these are usually between 300 and 500. Property taxes in Florida are paid in arrears.

Outstanding amounts owed on the property. Closing costs can include among others costs related to due diligence. This determines the value of the home for loan purposes.

Youll owe property taxes. The millage rate for Boca Raton is 18307 per 1000 of value so you are paying. Florida currently ranks number 23 for the amount of property taxes collected.

In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on. Youll be responsible for any unsettled payments on your home that can include HOA fees homeowners association and utility bills. The report goes on to state that counties in Florida collect an average of 097 of a propertys assessed fair market.

Floridas equivalent to the transfer tax is the documentary stamp. Hence the best way to ensure you will have the property tax in place before during and after the closing is to work with an expert title and escrow company. To calculate the property tax use the following steps.

The taxes are assessed on a calendar year from Jan through Dec 365 days. Transfer TaxDocumentary Stamp Taxes. Florida is ranked number twenty three out of the fifty states in.

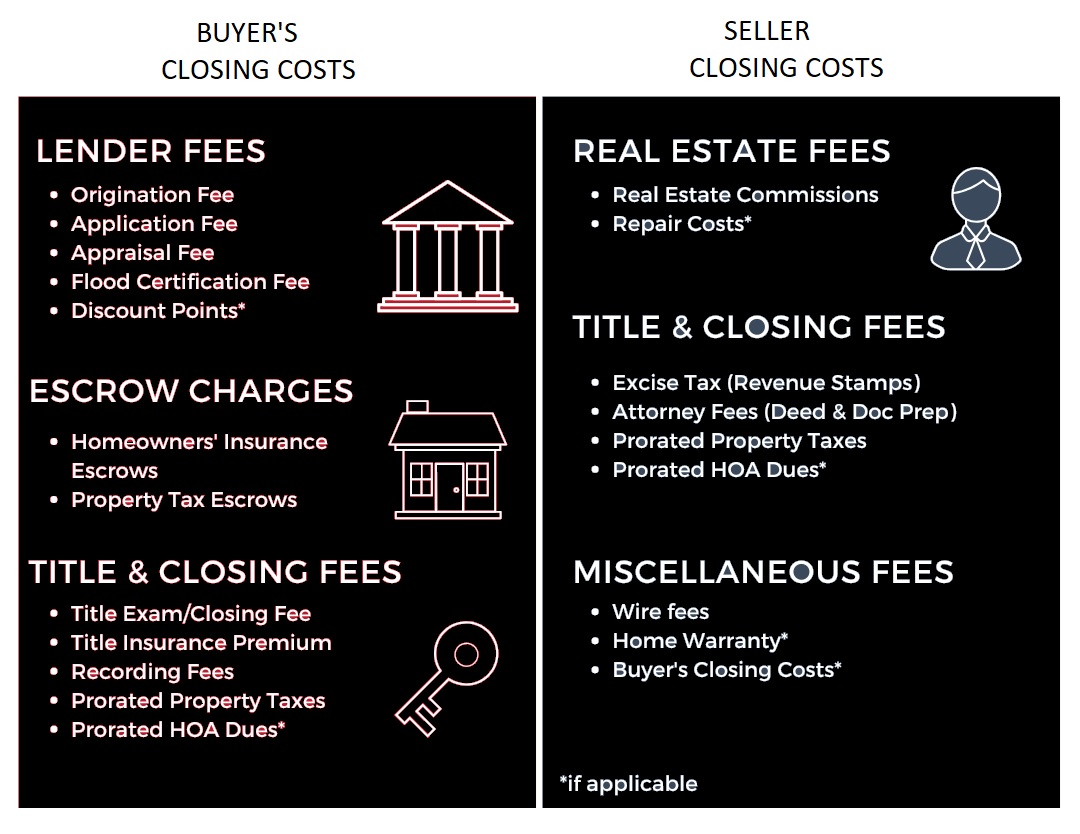

If you buy a property in that range expect to pay between. Dealing with property taxes during a real estate closing in Florida can be a stressful and time-consuming situation especially when you have to calculate all the related costs. Closing costs are a collection of fees dues services and taxes that are split between the buyers and sellers of real estate property and cover the additional expenses related to real estate transaction that are not included in the sales price.

This means essentially that if your closing takes place anywhere between January and the first week of November the amount of the current years property taxes will be unknown. Say Bob Burns is buying a home from Ted Smith the closing date is September 1st 2021 and the property taxes were 3500 in 2020. Lets say you have a home with an assessed value of 80000.

In calculating the sales tax multiply the whole dollar amount by the tax rate 6 plus the county surtax rate and use the bracket system to figure the tax on the amount less than a dollar. Find the assessed value of the property being taxed. Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year.

Knowing how to calculate your property tax expense is important in knowing whether you can afford a particular home.

Understanding Proration In Real Estate What Is It And Who Pays Home Bay

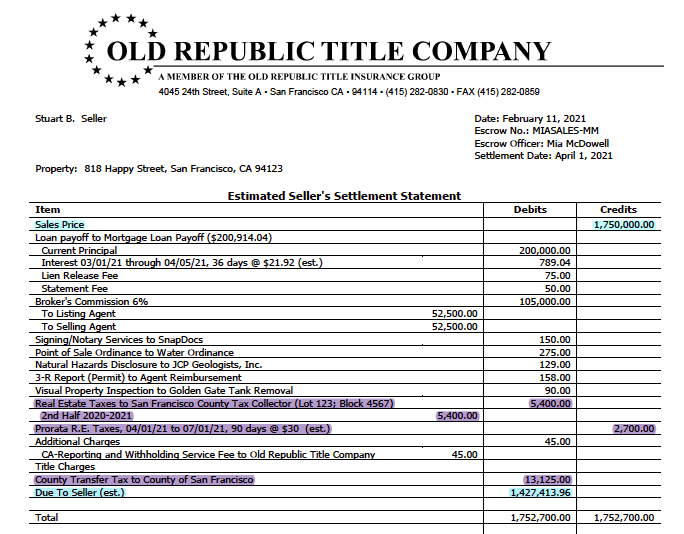

The Estimated Settlement Statement Jackson Fuller Real Estate

Blog Royal Shell Real Estate Real Estate

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Cape Coral

First Time Home Buying From A First Time Home Buyer Buying First Home Home Buying Process Home Buying Tips

What Are Florida Seller Closing Costs Hauseit Miami

Your Guide To Prorated Taxes In A Real Estate Transaction

1031 Exchange Tips Hauseit Capital Gains Tax Real Estate Terms Capital Gain

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Your Guide To Property Taxes Hippo

The Estimated Settlement Statement Jackson Fuller Real Estate

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Understanding Property Taxes At Closing American Family Insurance

What Should Homebuyers Ask Themselves Before Entering The Market Real Estate Buying Home Buying Real Estate Buyers

Closing Costs In Florida What You Need To Know